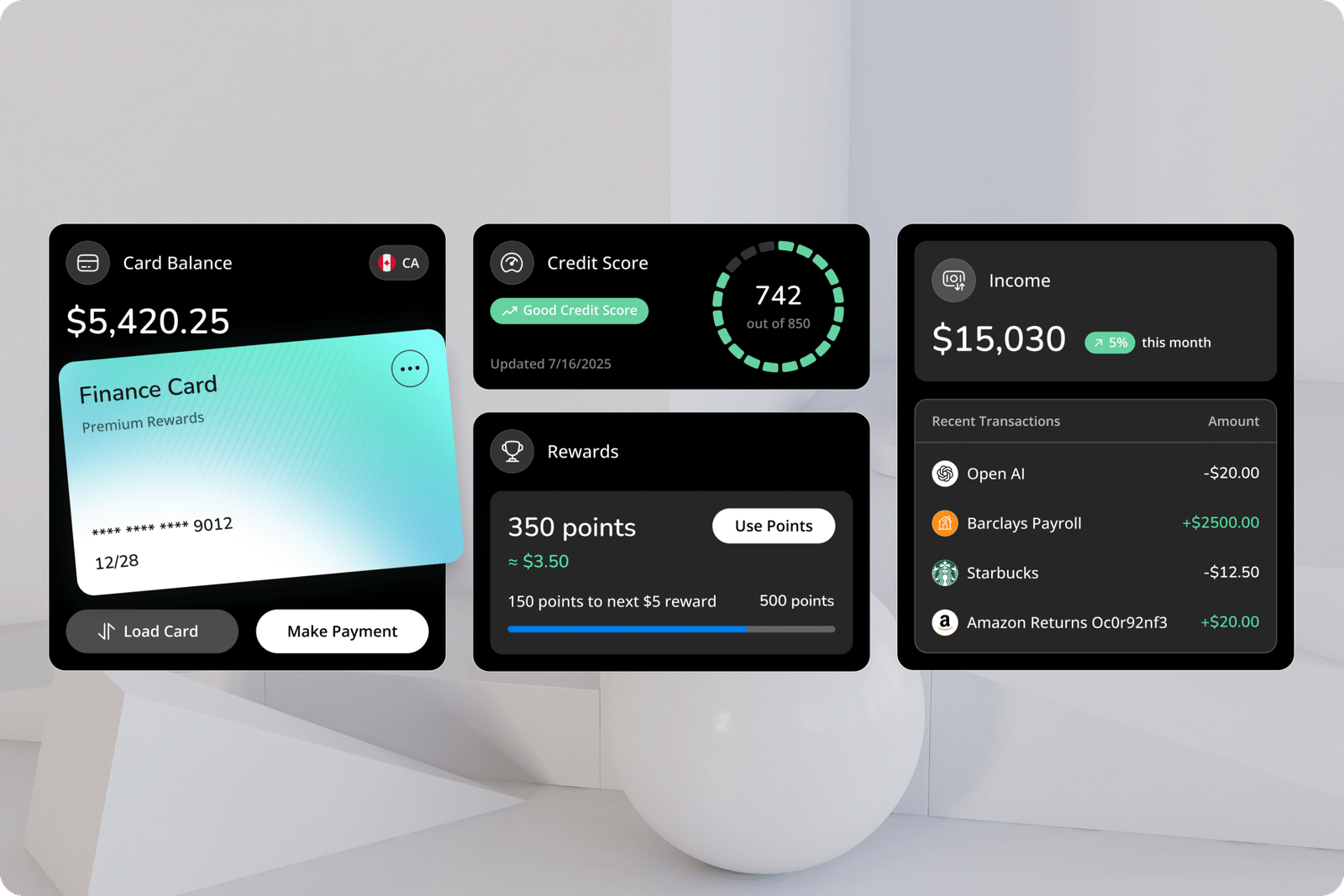

Plus Credit MastercardⓇ offers the perfect blend of security, control, and convenience.

With Plus Credit MastercardⓇ, the amount you load onto your card determines your spending limit.

This empowers you to enjoy the perks of credit cards without high interest rates or risk of overspending.

Why Choose Our MastercardⓇ?

Controlled Spending

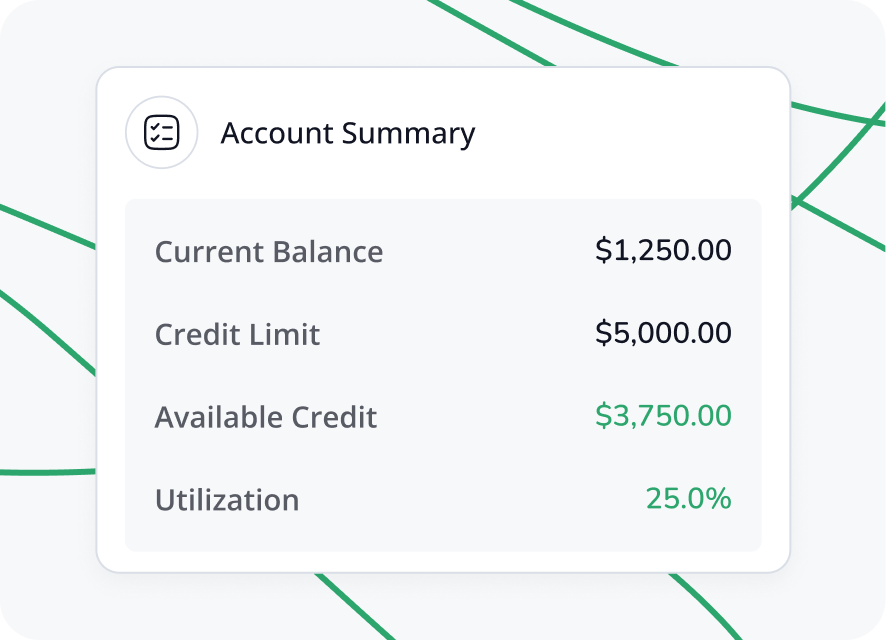

Your spending limit is directly tied to the amount you load onto the card. This means no surprises, no debt, and full control over your finances.

Card Benefits Without the Hassle

Enjoy flexible spending power and online shopping ease, all without the burden of interest rates or a credit check.

Cashback

Earn 0.25% cashback on all your day to day purchases.

Transparent Fees

With Plus Credit MastercardⓇ, you know exactly what you’re paying for. Say goodbye to hidden fees.

Seamless Reload Options

Add funds whenever you want through online transfers, direct deposits, or participating retail locations.

Common questions

There is no interest charge.

You’ll need a Canadian address, a government-issued photo ID (ex. driver’s license, passport, permanent resident card etc), plus your email and phone number.

You can earn cashback on any qualifying purchase transactions. This is applied towards your account as a statement credit.

Please note that cashback does not apply to bill payments, refunds, or any applicable exceptions stated in the cardholder agreement.

Yes! As long as you are a Canadian resident, are the age of majority in a province or a territory you’re a resident of, you meet are eligibility requirement.

While our Plus Credit MastercardⓇ is classified as a prepaid card, it includes features commonly associated with credit cards.

This means:

– Your card use activities are reported to credit bureaus

– You have a fixed spending limit (which you set)

– You receive monthly statements with cashback